VAT

VAT

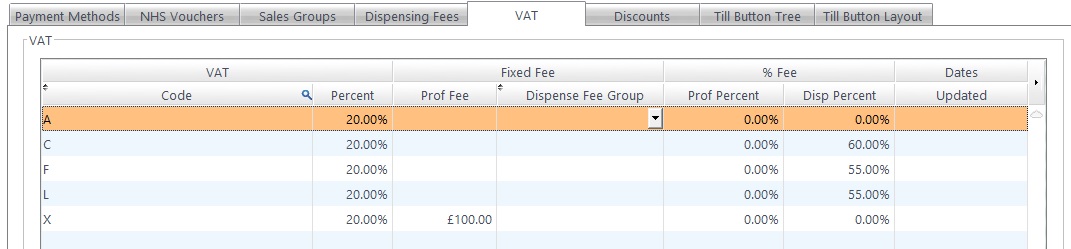

The VAT table sets the codes that are used in all the calculations, reports, and receipts for items sold via the till. The entries you make in this table will depend entirely on what you have agreed with your local tax office, be sure to have all the information to hand before making any changes to this screen.

The Code reflects what have been set in the Sales Groups, along with the default Percentage of 20.00%. Whilst slightly mis-leading at face value, this 20.00% should be left in.

The two columns that come under Fixed Fee allow any fixed professional fees (linked to Dispensing Fees) to be entered, and the % Fee can also be set, split between Professional Fees (Prof Percent) and Dispensing Fees (Disp Percent).

The date that this was last Updated can be added accordingly.

The new values will only be used for transactions / reporting from that point forward. To run a fix to update previous sales / payemnts with the new VAT values, please call us on 0845 313 0233.